With less than a decade left to prevent irreversible climate change, the world must take immediate action to reduce greenhouse gas emissions. And though 2020 may see a reduction in global emissions due to the COVID-19 pandemic, it is only temporary and does not represent a commitment away from fossil fuels.

It does, however, present a pivotal opportunity. As the global economy rebuilds, does it return to business as usual activities, or does it implement a green recovery plan that prioritizes a transition to zero-emissions? If we do the latter, we have a good chance of keeping global temperature rise within the acceptable 1.5° limit of warming that scientists have targeted.[1]

There are many pathways and solutions the world can take to achieve this goal, and among them is a price on carbon. This instrument has been put into practice to various degrees of success by both the public and private sector, as it has the potential for swift and far-reaching impact.

What is a price on carbon?

Since the Industrial Revolution, the world has taken advantage of the unchecked extraction and burning of fossil fuels to build global economies of scale. But these actions have undeniably come at a cost, one that has been left out of the equation for too long. These costs are something we can no longer ignore as the impacts of climate change become more apparent every day.

From an economic perspective, we are not appropriately accounting for the true cost of our actions when we burn fossil fuels and consume natural resources. To rebalance this equation, we need to establish a price for emitters that forces them to internalize the impacts of climate change. Per the world bank:

“…carbon pricing is an instrument that captures the external costs of greenhouse gas (GHG) emissions—the costs of emissions that the public pays for, such as damage to crops, health care costs from heat waves and droughts, and loss of property from flooding and sea level rise—and ties them to their sources through a price, usually in the form of a price on the carbon dioxide (CO2) emitted.”[2]

By crafting such a price, an economic signal is generated for emitters to re-evaluate their operations and decide how they will comply moving forward as they now have a new cost to consider. Naturally, emitters will look for ways to reduce that cost through various means, including investing in emission reduction technologies and low/zero carbon alternatives. Ideally, this market signal can help push the transition to a green economy much faster by making traditionally cheap fossil fuel industries no longer feasible when compared to greener alternatives, like solar and battery technologies.

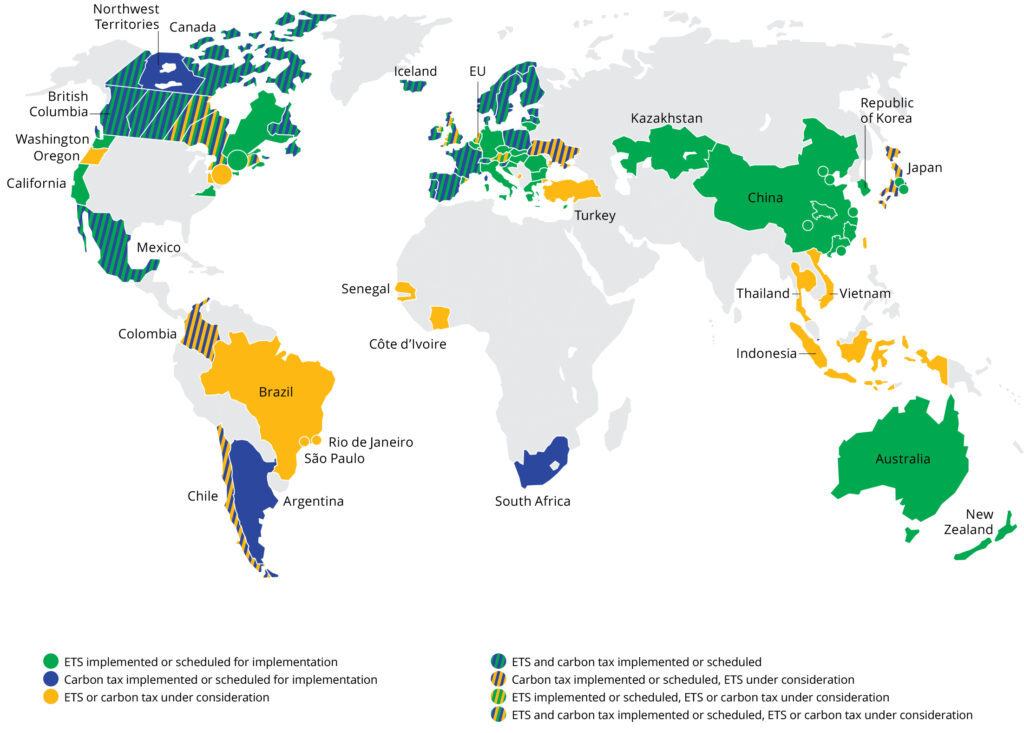

Currently, only about 22% of global emissions are covered by a price on carbon. However, there is no agreed upon price that is followed. Decisionmakers must decide what is a fair price that not only estimates future impacts, but also will help them meet their ambition and emission reduction targets. The World Bank has estimated that to be consistent with the ambition of the Paris Agreement (which has been critiqued for not being ambitious enough), carbon emissions should be priced at $40-80/tonne by 2020 and grow to $50-100/tonne by 2030.[3] Yet in practice, the global market price on carbon is wildly inconsistent ($139/ton in Sweden to $1/tonne in Ukraine).

This is far from ideal and has been a legitimate cause of concern for relying on carbon pricing as a panacea for climate change. Despite the inconsistencies, a price on carbon is still considered to be an effective tool if well-designed and if utilized as a complimentary action to tackle climate change with other solutions.

As the world considers how to restart post-COVID, a price on carbon might be an effective instrument to help lead the transition to a decarbonized world. To learn more about how carbon pricing can be deployed in the public and private sector, please visit our Carbon Pricing Examples Page.

At Seventh Generation Advisors, we are actively engaged in supporting carbon pricing instruments around the world as an effective solution to climate change. To learn more about this work, please visit our Carbon Pricing Solutions Page. Also – check out the recent blog by 7GA Carbon Pricing Advisor, Gregory Lopez on how Portland, Oregon is taking bold steps to put a price on carbon and curb pollution.

More Resources

For the latest trends and reports on global carbon pricing, we highly recommend visiting the World Bank Carbon Pricing Dashboard.

Citations

[1] https://www.nature.com/articles/s41558-020-0883-0

[2] https://carbonpricingdashboard.worldbank.org/what-carbon-pricing

[3] https://www.worldbank.org/en/results/2017/12/01/carbon-pricing