Carbon Pricing in Government

The most effective way to implement a price on carbon is through government policy and regulation because it can establish a sweeping set of rules and standards for emitters within the governing jurisdiction. And depending on the governing entity and its standing in the world economy, this could have far-reaching impact across many global industries.

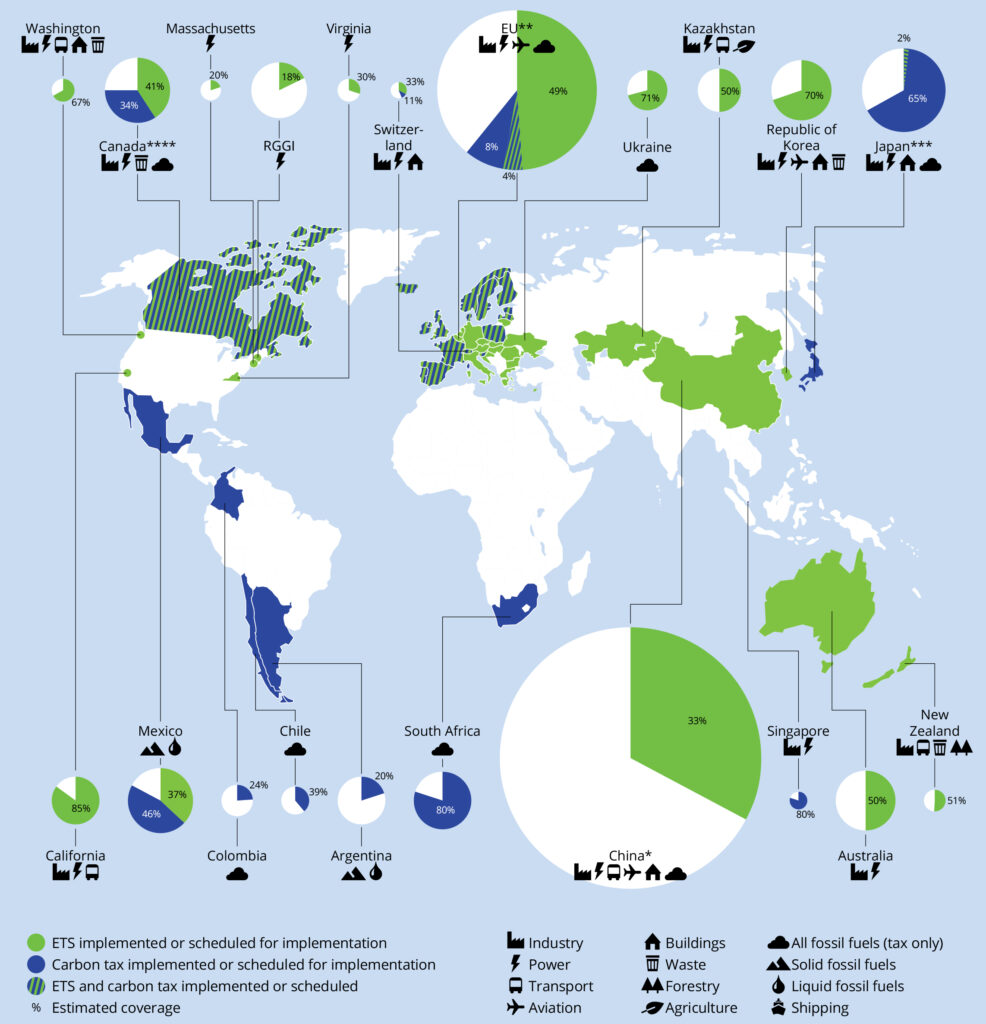

Currently there are 61 carbon pricing initiatives around the world covering about 12 GtCo2e (22% total). In practice, a price on carbon can take many forms, and often the sectors covered differ between each jurisdiction. California for example, has 85% of their emissions covered by a pricing instrument, but it only covers Industry, Power, and Transportation sectors. On the other hand, the Republic of Korea covers 70% of their emissions by placing a price on Power, Industry, Aviation, Buildings, and the Waste sectors.[1]

Though it could be argued that carbon pricing could be expanded in these geographies to cover 100% of a jurisdiction’s emissions, it may not be feasible to do so. Even in areas that have implemented flat taxes on all fossil fuel emissions like South Africa and Ukraine, there still remains a gap of emissions not covered. Therefore, it’s important to consider the scope and limitations of carbon pricing and how it can be a complimentary solution to other climate mitigation activities.

As a policy instrument, the two most popular forms of a price on carbon are an emissions trading scheme (ETS) and a carbon tax or fee. In practice, ETS and carbon taxes are split evenly among jurisdictions implementing a price on carbon (31 to 30).[2] Researchers have found that either, if well designed, can be an effective tool to reduce emissions.[3]

California’s Cap and Trade program is an example of an ETS. Launched in 2013, this program covers about 85% of the state’s emissions and has generated 5 billion dollars for emission reduction projects.[4] The program caps emissions allowed annually and thus creates a market of carbon credits for emitters to trade if they have a surplus (under the cap), or if they have a deficit (over the cap). Credit transactions are done via auction, and with every sale, proceeds are generated and allocated to the state-owned Greenhouse Gas Reduction Fund (GGRF).

The Cap and Trade program has faced its share of criticism, ranging from not being effective enough to unfairly burdening disadvantaged communities (which often live near high polluting industries that may continue operating so long as they purchase credits to remain under the cap). However, the State allocates 35% of the GGRF to low income and disadvantaged communities and it is now reporting that the program is on track to produce a 15% reduction in emissions by 2020 compared to business as usual activities.[5]

On the other hand, a carbon tax or fee is a relatively straightforward way of pricing carbon for policymakers. A set cost is levied on emitters, which is paid into a fund that often, like the GGRF, funds emission reduction projects. In 2019, South Africa became the first African country to launch a carbon pricing instrument by establishing a carbon tax of about $8.34 per ton/CO2e across the country.

Some researchers have called this price too low and not enough for the country to meet its targets in the near future.[6] However, the tax will be applied in two phases. The first will end in 2022, at which time the tax will be re-assessed for its price to ensure its efficacy in aiding South Africa to meet its emission reduction goals.

In addition to these two examples, Argentina, Australia, Canada, Colombia, Kazakhstan, Japan, New Zealand, and the European Union have all implemented carbon pricing schemes. The EU system, launched in 2005, is a unique blend of instruments. As a whole, the it is structured as an ETS and is the largest emissions trading market in the world.[7]

The EU ETS has two caps that cover about half of all emissions, one for energy installations for power generation and manufacturing industries and the other for the aviation sector. From 2013-2020, the cap placed on emissions decreased by 1.74% per year, which resulted in a 21% reduction in emissions from 2005 levels. And much like the California GGRF, the EU utilizes auction proceeds to fund large-scale projects of low-carbon technologies.

However, in addition to the ETS, several countries within the EU, including France, Sweden, and Poland, have implemented their own national carbon tax to varying degrees of success. In 2018, France saw weeks of civil unrest led by taxi drivers and others, known as the “Yellow Vests,” who protested against the rising costs of gasoline and diesel prices due to the carbon tax. The Yellow Vests were successful with their protest, as President Macron halted the carbon tax at €44.60/ton, where it has stayed since 2018.[8]

Carbon Pricing in the Private Sector

Without government policy and regulation, the private sector may to choose to act on their own and impose a carbon price for their emissions. Depending on the size of the company and its supply chain, a company taking action could have a sizeable impact across its industry as suppliers and partners will also be pushed to lower emissions and engage in more sustainable practices. Like the varied approaches that can be taken by government, the private sector also has different options for methodology and pricing.[9] Two of the most common are a “shadow price” and an “internal carbon fee.”

A shadow price is a way for companies to place a monetary value on carbon emissions to assess the risk of future investments and expenditures in anticipation of future regulations on carbon emissions. A recent example of this can be seen with BP (Beyond Petroleum), which raised its carbon price forecast to $100/ton by 2030 from the previous $40/ton valuation. BP will use this price to conduct risk assessments and profitability forecasts with its future portfolio of oil and gas operations as they anticipate more aggressive global policies to transition to a low-carbon economy.[10]

On the other hand, an internal carbon fee is simply a self-applied tax that the company charges itself for its own emissions. In 2012, Microsoft set an internal carbon fee that is paid by each division in the company, and with those funds, Microsoft invests in sustainability improvements. Currently, this fee sits at $15/ton and covers Scope 1-3 emissions. This carbon fee is only one tool of Microsoft’s larger climate and sustainability initiative, which has now set a goal for the company to be carbon negative by 2030.[11]

Carbon Pricing in Society

Though there may be environmental fees or other taxes passed onto retail customers for products, there is no set carbon price for the general public to pay. There are, however, plenty of voluntary calculators in place that allow people to estimate their carbon footprint. And once known, anyone may choose to purchase carbon credits to offset their impact through global mechanisms like REDD+, which provides emission reduction credits from the sustainable management of forests.

If you are interested in calculating your own carbon footprint and offsetting your impact, we recommend the following public carbon calculators:

Citations

[1]https://openknowledge.worldbank.org/bitstream/handle/10986/33809/9781464815867.pdf?sequence=4&isAllowed=y

[2] Ibid.

[3] https://www.wri.org/blog/2016/03/carbon-tax-vs-cap-and-trade-what-s-better-policy-cut-emissions

[4] https://www.c2es.org/content/california-cap-and-trade/

[5] https://ww2.arb.ca.gov/sites/default/files/classic//cc/capandtrade/guidance/cap_trade_overview.pdf

[6] https://www.npr.org/2019/05/26/727154492/south-africas-carbon-tax-set-to-go-into-effect-next-week

[7] https://ec.europa.eu/clima/sites/clima/files/factsheet_ets_en.pdf

[8] https://globalnews.ca/news/4728184/france-carbon-tax-riots-canada/

[9] https://www.wri.org/blog/2018/04/4-ways-companies-can-price-carbon-lessons-india

[10] https://www.greentechmedia.com/articles/read/european-oil-majors-ready-to-scale-up-energy-transition-investment

[11] https://blogs.microsoft.com/blog/2020/01/16/microsoft-will-be-carbon-negative-by-2030/